With the final stretch of the 2018 midterm elections now underway, Borrell Associates has modestly upped its forecast for how much radio will book in political ad sales this year. AM/FM stations will capture $689.0 million of the $8.93 billion election ad jackpot, up 0.8% from the April forecast of $683.4 million.

The new August 2018 forecast is the second consecutive upward revision for radio since Borrell began issuing forecasts for the 2018 elections in December 2017.

As candidates and political action committees grab the big guns to begin blasting their way toward Nov. 6, radio is on track to grow its political ad intake by 11.3% compared to the 2014 midterms. Radio is expected to grow its political share to 7.7% in 2018, up from 7.5% in 2014.

“Radio’s gains since 2014 are due to better funding for campaigns running below the state level,” the media financial advisory firm says in “Bracing For Impact: 2018 Political Advertising Set To Break Records,” a new 22-page report that breaks out the numbers from every conceivable angle. “Once largely ignored by parties and consultants alike, the realization has dawned that these elections determine control of state Houses and major communities. They decide issues important on national as well as local levels and develop the politicians who will one day contend for national offices,” the new report says. “So, politicians who once worried only about where to place their signs now vie for radio time.”

But while calling for a bigger slice of what is expected to be a record-breaking midterm ad pie, the report also comes with a caveat about growing competition in the larger audio space. “Whether stations can maintain their political share in the face of digital competition remains an open question,” the report’s radio section continues. “Pandora and other alternatives continue to chip away at radio’s share as well, and podcasting, though quite small as an advertising medium, offers another threat.”

‘Frenetic Activity’

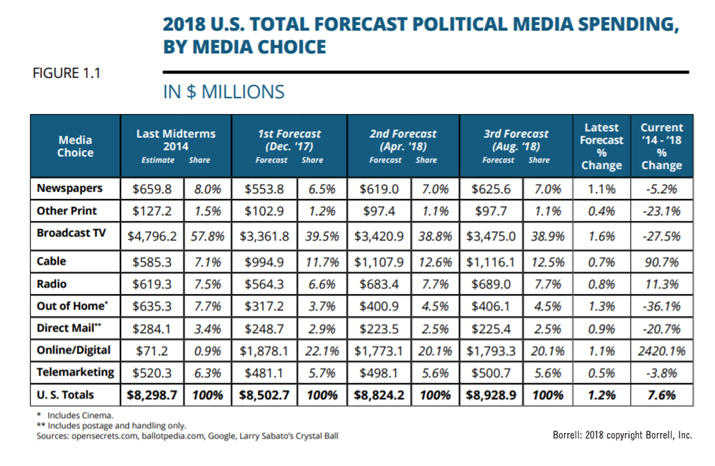

Back in December 2017, Borrell estimated the 2018 midterms would draw $8.5 billion in advertising. Since then, the “frenetic activity” surrounding the primaries combined with monitoring of fund raising by PACs caused the firm to add more than $400 million to the total. The new outlook is for a record $8.93 billion in total political ad spend this year, up 1.2% from the April 2018 forecast and 7.6% higher than the outlay in the 2014 midterms.

To no one’s surprise, broadcast TV will vacuum up the largest share this year, netting some $3.47 million or 38.9% of the political pie. And in another data point showing how online/digital has exploded as an advertising medium, the channel is now expected to cordon off a staggering 2420% more in political ad sales in this election cycle compared to 2014, totaling $1.79 million or 20.1% of the pie. That marks a Herculean leap from the last midterms when online/digital got only $71.2 million or just under 1% of the pie. Cable is third with 12.5% or $1.12 billion, followed by radio in fourth place.

Less than one third of that $8.93 billion in political ad booty has already been spent, indicating that advertising media are in “for a nine-week cash frenzy that will clog the airwaves, newspapers, digital screens, billboards, mailboxes, and yards with political messages,” the report says. In some key battleground states, political will leapfrog ahead to become one of the top ad categories this fall. In Florida, for instance, the $563 million that’s forecast to be spent will make political the second-highest spending category in the Sunshine State, behind real estate and bigger than automotive. In Wyoming, where $14 million is forecast, it’s the third highest ad category, behind automotive and restaurants.